GST Registration

GST is tax on sale, purchase and services. Central Government manage tax on goods and services provided by companies, business man, consultant to other companies, businessman, consultant, end clients and end users.

GST Registration is one time registration and no need to renewal. GST registration also work as new proprietorship firm registration for starting business and open current bank account to manage sale, purchase and consultancy. We will take 1 to 2 days time for apply GST Application after receiving all required documents then GST Department will take 1 to 15 days to issue GST Registration Certificate and GST Registration Number.

The tax came into effect from July 1 2017 through the implementation of One Hundred and First Amendment of the Constitution of India by the Indian government. The tax replaced existing multiple Central and State Government taxes.

The tax rates, rules and regulations are governed by the GST Council which consists of the finance ministers of centre and all the states.

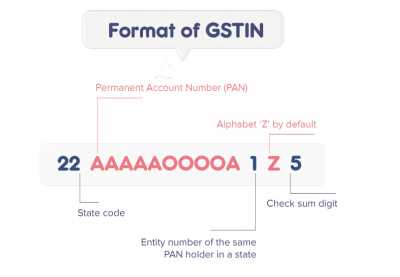

Registered taxable person will be allotted for each State/ UT having business places a PAN-based 15-digit GST Identification Number (GSTIN)

BENEFITS OF GST REGISTRATION

- We Legally collect taxes From your Customers and Pass on the Tax Benefits to Suppliers.

- Business Becomes 100% tax Compliant

- We Can Claim Input Tax Credit which you have paid on your purchases and Improve profits.

- GST certificate can be used as one of the document while opening current account or Business Account.

- You can easily apply for various state and central government tenders if you have GSTN.

- Expand Your Business through various channels like Online, Import-Exports,

- To start payment gateways, use mobile wallets GST number is used.

DIFFERENT TYPES OF GST REGISTRATION?

Under composition Scheme:

The composition scheme is for the small taxpayers in order ease the tax compliance for them, this scheme allows eligible taxpayers to pay a percentage of their yearly revenue as a tax. Like small retailers, eateries and trading businesses. This will relive the taxpayers/ Businesses from collecting taxes from their customers directly and adds benefits as mentioned below:

- File Single Quarterly Return, not multiple monthly Returns.

- Pay Lower Tax which gives competitive advantage

- Books of Accounts and Records are Easy to maintain under GST norms.

Following is the Eligibility Criteria To register under GST composition Scheme :

- Must be a Registered Taxpayer

- Annual Turnover Should be Less than 1cr

- Manufacturers of goods, Dealers, and Restaurants (Not Serving Alcohol) can option for this scheme.

Registration As a casual Taxable Person:

Casual taxable person is a person who supplies taxable goods or services occasionally like a event management company which has various events in different states needs to register as a casual taxable person for that particular taxable state before supplying or offering any goods or services.

Suppose Mr A has a business of consulting and who provide services in different state, then he needs to register as a casual taxable person under so that his business is compliant with the tax norms of that particular state.

WHO NEEDS GST REGISTRATION NUMBER?

- Businesses Having Annual Turnover More than 20 Lakhs Per Annum (10 Lakh for North Eastern States)

- If Business is dealing in More than One State

- If your Business has Previous registration Under VAT, Excise Laws, Service Tax Laws

- Selling Your Goods or services Online (Like on Amazon and Flipkart)

- If you are Providing Services and Goods Outside India.

Process Of GST Registration On Govt.Portal

GST Registration Steps Under this line

1 Open Govt Portal and click Registration Option

2 Enter Pan , Email Id, Mobile No, and Start Part A Form GST REG -01 Of GST Registration

3 After that Receive a Temporary Refrence Number On your Register Email Id and Mobile Number

4 Then Need To Fill B Form GST REG 01and upload Required Documents With signed ( DSC AND EVC )

5 Acknowledgment Slip Generated in form GST REG 02

6 In case any mistake of Documents in form GST REG-03 to visit the department for clarify within 7 working days Regarding form GST REG -04

7 If any case your application will be Reject if find any errors. You can Inform about this in Form GST REG -05

8 If no errors found then finally Register Certificate will be Issued to you by the department after verification and Approval in Form GST REG -06

PENALTIES INVOLVED UNDER GST ACT

- Not Having GST Registration : 100% tax Due or Rs10,000 Whichever is Higher

- Not Giving GST invoice : 100% tax Due or Rs10,000 Whichever is Higher

- Incorrect Invoicing : Rs 25,000

- Not Filing GST Tax Returns : For Nil Return its Rs 20 Per Day, Regular Returns Rs 50 Per Day.

- Choosing Composition Scheme Even if not Eligible : 100% tax Due or Rs10,000 Whichever is Higher

Documents for GST Registration

- PAN Card of Owner/ directors/ partners.

- Bill of Electricity/ Telephone, Rent Agreement or Letter of Consent (NOC).

- MOA/ AOA or Partnership Deed

- Letter of Authorisation for signatory.

- Bank statement/ Cancelled Cheque.

What is GSTIN?

1.The Fist 2 Number in the 15 Digit GSTIN will the state code . example 06 for Haryana ,03 Punjab, Etc.

2. The Nest 10 Number will the Pan Card of GST Apply person in Business.